It was on the first day of Chinese New Year that the old man reminded himself to be anodyne. The year of the wood dragon, was according to his Mrs, going to be a bad year for those of the dog sign. The old man grunted and growled under his breath when he heard it. Nothing new, he thought to himself. When was it ever a good year? For the dragon, it was always prosperous and fortuitous. For the dog, predictably, difficulties and threats would be the norm again. Life had a way of making it unequal for people who supposedly were all born equal. Another year of troubles and challenges? His life had been set in aspic for decades, it felt to him. Nothing ever changed, the sun would rise but it would also set. Good luck didn’t visit much and even if it did, it turned bad pretty quickly, at times even before the sun called it quits for the day. Maybe it was his imprudence that got him in trouble with people around him. Never one to care for what people thought of him, he felt free to speak his mind about virtually anything. Unrestrained, provoking and somewhat gung-ho, a friend a long time ago said of him. He had read about Cato The Younger’s wise words but he told himself he wasn’t Cato.

Speak only when you are certain what you’ll say isn’t better left unsaid.

Cato The Younger

In a chat group, a chap tried to stop him from sharing his views about cryptocurrency. Someone had taken exception to his constant pontification about Bitcoin being the superior money, so the friend reached out and advised him to quieten down. When Bitcoin news became quotidian from one person, it meant people had already switched off and returned to their siloed world.

“Okay, okay. I shall be anodyne,” said the old man who grimaced at being told the truth that he had been soporific about the topic. His face turned cold and marmoreally stiff until an itch in his throat made him cough out the bitterness that had darkened his mood. His past troubles had left him in the dark abyss but he felt comforted in the knowledge that he had survived and that nothing more could destroy him.

“You’re as deflating to my mood as the Bitcoin price,” he added, after seeing that BTC had again dropped in value.

He was not heard of again for the rest of that day; the first day of Chinese New Year had been uneventful and less auspicious than he had hoped, despite wearing a pair of red undies to placate his Mrs who read in a magazine that dogs should be low key on the day, to wear red for good luck but not to attract unwanted attention from the gods.

Stoics emphasise the importance of prohairesis – it is reasoned choice that makes a rational action. Anything outside our prohairesis should not be met with emotional reaction, because anything outside our reasoned choice is not within our control.

So, the following day, the old man was at it again. He wrote to his friends:

Thinking aloud allowed. Bitcoin is going through what the internet went through in its early years. Back then, the internet was a place for pornography and scams, most websites were not interactive and there was no social media. Even when online retail was introduced, most of us were sceptical, scared of being scammed or have our credit card details stolen. The internet would never work, people would not adopt it, right? Yet, Metcalfe’s Law proved people wrong. Technological adoption takes time, it happens slowly, then suddenly.

Is the adage, ‘Don’t put all your eggs in one basket’ outdated? Having played poker and losing badly, isn’t it the decision to go all-in right if you are holding the best cards? What can be better money than Bitcoin today? Every asset class pales in their performance vis-a-vis Bitcoin in the last 15 years. The big risks are actually holding your wealth in fiat money and assets that can be seized by powerful governments and corporations. If they can do it to Russia, a superpower with nuclear weapons, they can do it to all of us.

In South Australia if you own more than one property you’ll be paying land tax at about 9% every year. That’s daylight robbery. There are also repairs and maintenance expenses and council rates and taxes, further robbing the landowner of their wealth in broad daylight. In the UK and many other countries, there is death duties – governments robbing the dead, one may say.

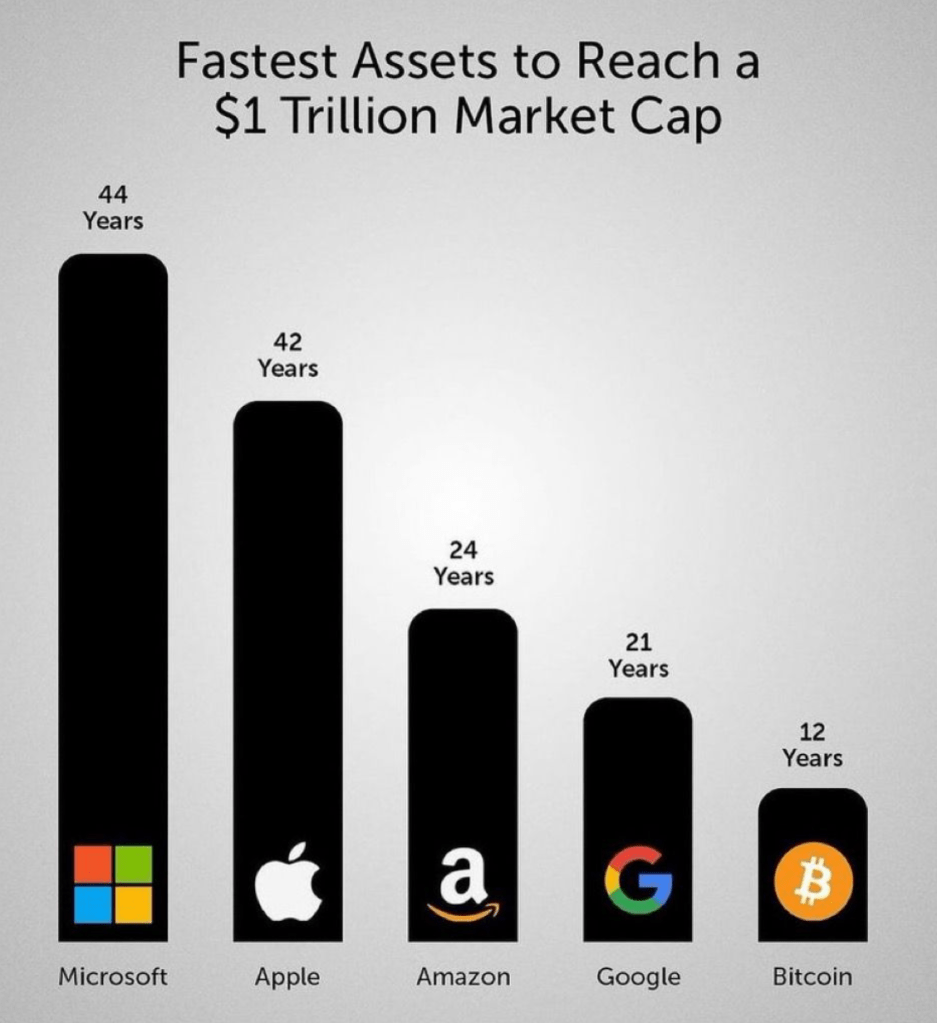

When Apple was 15 years old, its share price was $0.28. When Nvidia was 14 years old, its share price was $3.93. BTC just turned 15 this month and people reckon it’s too late to invest in it? I know, I know. Maybe, I am wrong to trust myself.

If some regard you as knowledgeable, then it’s time to distrust yourself.

Epictetus

After the old man’s loud outbursts, a longtime friend in Melbourne thought to share the serenity prayer to calm their fellow friends.

God grant me the serenity

to accept the things I cannot change;

courage to change the things I can;

and wisdom to know the difference.

The old man replied, “That’s something I don’t get. To accept things we cannot change. Why? Can we not simply ignore them?”

Why accept mockery when it’s easier to ignore it?

He asked himself, remembering the times he was mocked by people around him for talking about Bitcoin. He thought it strange that people would be antagonistic about the new money, a digital money for the digital world made perfect sense.

His friend replied, “Yes, I agree it is hard to accept initially. Look at it in the context of personal growth, acceptance and resilience. To recognise the limits of our control and to focus on what we can change. Then, there could be serenity in us. It’s not only spiritual, it’s also a concept of psychology.”

Someone else added, “It’s all in one’s mind. To each one’s own. The extremes of acceptance, rejection and questioning can only be self determined based on one’s own reasoned choice. Hence the phrase, choose wisely.”

The old man thought otherwise but bit his tongue until he could taste blood to stop himself from speaking up. It is quite impossible to be happy when there’s a yearning for something we do not possess. Wish not, want not. If we have to choose, then there is always going to be something else that we miss out on. His Mrs had just finished her breakfast that comprised of two rather thick slices of home-made bread generously painted with rich coatings of butter and home-made plum jam. He licked his lips and felt his stomach complain but he had another hour and a half to go before he would eat again. His choice to abstain from food made him unhappy.

Choose it or your happiness – the two are not compatible

Epictetus, Discourses

He settled on a glass of water instead and continued to write to his friends. Outside in the garden, the stillness of the crisp air warned him autumn was arriving early. Skeletons of leaves left from many seasons ago would soon be joined by fresh red and brown ones. He wished they would take their one chance to fly and soar high before they fall.

In 2019, one US dollar bought 0.00013888 BTC. In February 2023, a dollar bought 0.00002114 BTC, i.e. it devalued by 85% in just four years. The old man laughed at his own intransigence. He rejected the merits of Bitcoin for three years and argued convincingly that the governments would never allow it to be legal tender or as a legal form of investment. The price of Bitcoin was around $4,000 when his son broached the idea of adding Bitcoin to their company’s treasury in 2019. Had he agreed with the younger man, his first-born, they would have seen a twelve-fold increase to their balance sheet.

We laugh when we are alone because we alone know how much we suffer.

Nietzsche

All the assets in the world i.e. share markets, real estate, gold, commodities, bonds, etc totalled over $900 trillion. Since Bitcoin is the best store of wealth, then individuals, sovereign states and institutions that spread their investments across the markets would eventually send big inflows into Bitcoin. Over time, if these investors allocate just 1% of their assets into Bitcoin, how much will BTC become? There are only ever going to be 21 million coins mined, with the last one million coins to be issued by the year 2140. 1% of $900 trillion divided by 21 million. Actually, in the early days, people did not know how to store their coins safely and some 5 million coins were lost forever. So, 1% of 900 trillion divided by say, 15 million coins. I’ll let you do the maths. We are still early, guys. But only get in if you can hold during the volatility. The price of BTC can only go but up in the next few years.

Fiat money is the biggest Ponzi scheme ever! Introduced in 1971, it is in its death throes in America. $34 trillion in debt at ever increasing speed. The more they print the less value their money become. Bitcoin is backed by tens of thousands of super computers all over the world, keeping the blockchain verified and secure. It reached an all-time high rate of 545 exahashes per second recently. In history, monies eventually fail when people lose their belief in the system. Fiat money will eventually fail. Governments have been reckless especially since 2008, merrily printing money thereby raising debt for the next generations to pay off. The mighty US dollar lost its shine once the world witnessed it was used to sanction another country with nuclear power. The Malaysian ringgit, depreciating rapidly against many currencies will eventually fail also, following the trend of other weak currencies.

A Bitcoin is mined every ten minutes approximately when a block of transactions reaches 550 Gb of data. The Bitcoin blockchain is a public ledger of global Bitcoin transactions. The computer that solves a complex mathematical problem set by an algorithm wins the Bitcoin for that block. For the first time in history, money is therefore totally decentralised and cannot be manipulated, seized or simply increased by an authority. For the first time in history, we have a commodity that is absolutely scarce, capped at 21 million. Every four years the reward to miners for securing the network is halved. The daily number of Bitcoins will reduce to 450 from around April 20 2024. Bitcoin is digital money, not physical, therefore it is easily divisible, fungible and cheaply stored, and can be transported at the speed of light – features that outshine gold, pardon the pun. It is valued in any currency, currently it is worth about MYR250,000 per BTC. The cost to mine one Bitcoin has been reducing gradually as they move to renewables, hydro and volcanic energy and gas flares that would otherwise be burned off and wasted. The last time I checked, quite many months ago, the unit cost of a BTC to a mining company with the most powerful computers was around USD17,000.

“It’s all good until there is no internet or electricity,” the friend argued.

“No electricity in the world? No internet? The world will not run out of energy. It never has. The day we run out of energy is the day the world is destroyed in which case nothing matters,” the old man replied before he continued spreading his theory about Bitcoin.

Here is my summary of the Malaysian median house price in MYR and BTC showing how Bitcoin protects our wealth from the debasement of fiat money through irresponsible money printing. It will take just a few more years before we can buy a median-priced house in Malaysia with just one Bitcoin.

Source: https://www.statista.com/statistics/1440092/malaysia-house-price-index

His friend said people who risk their savings to buy Bitcoin are greedy.

“Why accumulate more at our age?” he asked.

“Sure, for some, it is due to greed. For many others, it’s a migration to a better, more secure, hard money that will protect their savings. It is not that we want to accumulate more, the goal is to swap to a better money so we don’t sit on a pile that devalues by 10-15% every year,” the old man countered.

“It is not greed. People who are blessed with financial security should not denigrate those less fortunate ones who need to protect their assets the best way they can.”

Another friend disagreed.

“I am a fundamentalist and a long term investor most of the time. It requires a lot of patience and discipline. Not only do I look at the performance of an investment using the various valuation methods, quality of management and strength of the sponsors but also the macroeconomics that may have future impact on the investment.

E.g. with the US stock markets hitting an all-time high, it’s time to be fearful when others are greedy – Warren Buffett. The valuations are simply too ludicrous right now. If I do get into the market, it’ll be with a trader’s mentality to buy when there’s a correction and sell when prices rise but never intend to hold it long term unless its valuation is dirt cheap and business fundamentals are still strong despite minor setbacks. By the time the Feds pivot on interest rate cuts, the US economy will be in a recession and there’ll be a major correction, perhaps a crash. As ex-PM Najib said, “Cash is king!” If one expects a recession is imminent, wait for the crash to come, there’ll be plenty of opportunities to pick up quality investments at low valuations. Also I am an advocate for risk diversification. Don’t put all your eggs in one basket.”

“I don’t follow the diversification strategy. I prefer conviction. For instance, in my business, all I do is sell X. We do not suddenly choose to sell X, Y, and Z. Spreading our risks is reducing our profitability, diversifying into categories we are weak in or unsure about is lunacy,” the old man replied.

“All I’m doing here is to highlight to my friends that there is a much better way to protect our wealth. The CEO for Blackrock, Larry Fink, for years, was saying Bitcoin’s use is for scams and criminal activities. Blackrock is accumulating a billion dollars of Bitcoin daily since they got their ETF approved three weeks ago. When priced in fiat dollars, the S&P 500 gained 24% over the last year and we thought we had a bumper year. When priced in BTC , it lost almost 40%. That’s how we ought to protect our assets.”

In time to come, Bitcoin adoption will mean merchants will stop accepting Visa and Mastercard credit and debit cards. Why would they want to pay 2-3% in fees, wait 5-7 days for the funds to settle and accept merchant chargebacks without recourse when Bitcoin transactions are irreversible and the fees negligible?

My BTC topic maybe soporific but I’m still agog that its absolute scarcity and its finite supply do not seem to resonate with many here. It is the first time in history that we have money that has both such features, yet it doesn’t dawn on people and the general response is just a big yawn.

“That’s because money can’t buy happiness,” his friend said.

“Money can buy happiness actually, it’s just that happiness isn’t a permanent state, nothing is. Like money in my bank account, it is never there permanently,” said the old man.

“We can’t even buy a cup of coffee with Bitcoin here,” said the friend who was starting to annoy the old man.

“Try buying bread with gold or marbles,” the old man retorted after deciding his friend was thick as a brick. He was not giving financial advice and neither was he saying he owned any Bitcoin. It was a phenomenon that piqued his interest and he simply wanted to learn more about the new technology, especially about a new form of money that could change the world for the better. Some said Bitcoin could even stop wars, since wars are very costly to fight for long spells.

But, his disbelieving friend had the last say.

“You’re just as loud as a lout.”